In the realm of real estate, decision-making is a finely tuned instrument. Every choice echoes through the caverns of capital, shaping skylines and futures. But what happens when a single decision, an A/B test mistake, reverberates so intensely that it spirals into a $50M misstep?

Imagine a scenario: a developer is on the brink of launching a new high-rise, a beacon of innovation in a bustling cityscape. They decide to A/B test different marketing strategies, pitting the allure of sleek modernity against the timeless appeal of classic design. The focus keyphrase here is ‘A/B test mistake,’ for what they perceive as a safe, data-backed choice soon becomes the first domino to fall.

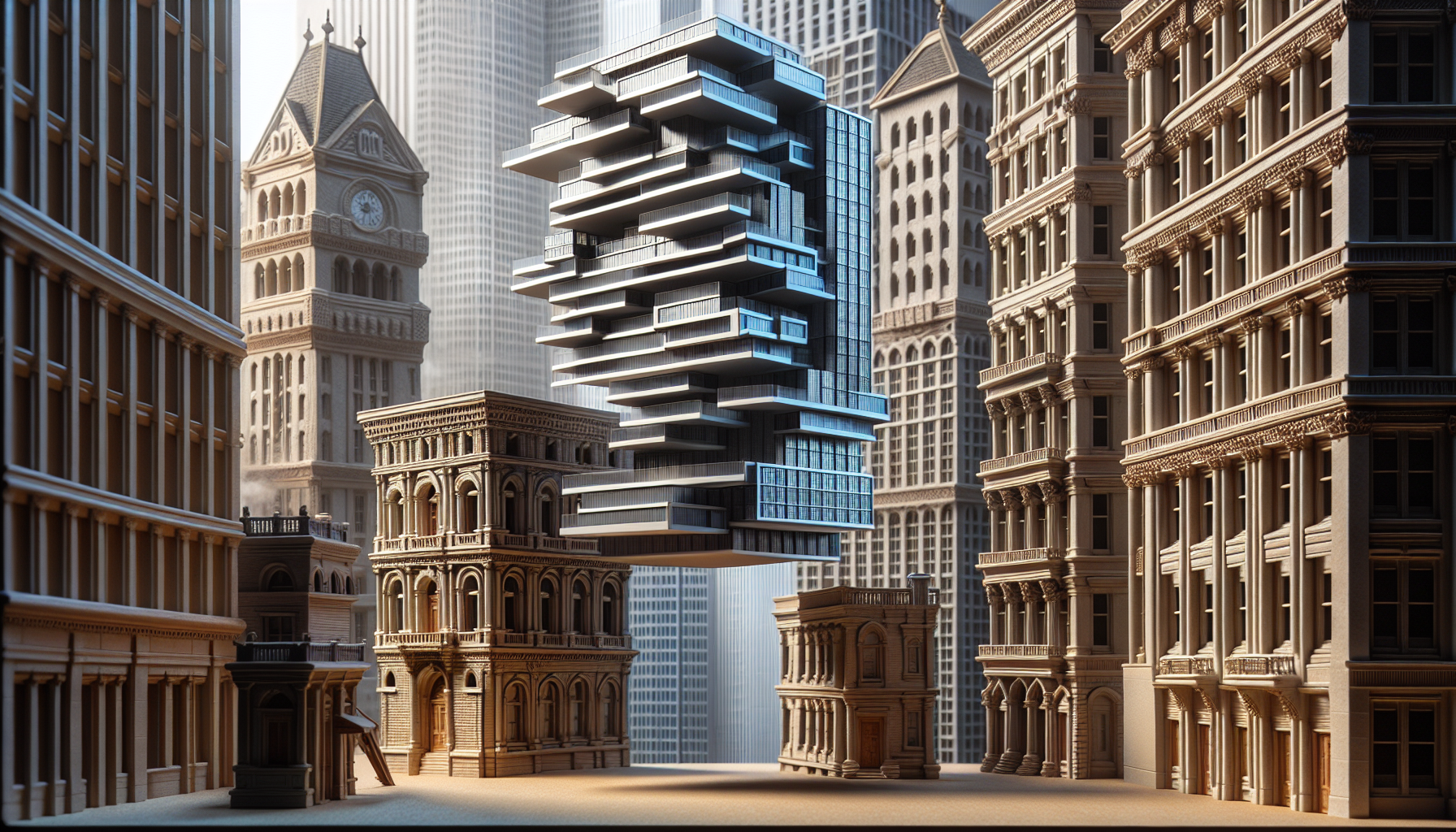

The A/B test runs for weeks, illuminating patterns and preferences among potential buyers. The data skews heavily towards modernity, prompting the developer to double down on this direction. They shift architectural plans, reallocate budgets, and, most importantly, commit to this interpreted insight. Yet, in their zeal, they overlook a critical flaw—contextual alignment. The neighborhood’s cultural leaning, veering towards preserving heritage, conflicts with the modern aesthetic.

Reflective insight begins to emerge: A/B testing, while powerful, is not infallible. It lacks the qualitative nuances that a seasoned real estate strategist would intuitively grasp.

Here, buyer psychology holds a mirror to decision-making. Consider the case of ‘Sunny Apartments,’ where a similar A/B test mistake cost developers more than just financial resources; it drained public trust. A landmark building, reimagined as ultramodern in a traditional district, faced backlash and plummeting sales. Buyers, rooted in the history of the locale, rebelled against the encroaching skyscraper. Harvard Business Review: Why People Buy Things They Don’t Need highlights our complex motives, reminding us that numbers alone can’t capture emotional resonance.

In market dynamics, timing is as crucial as placement. A $50M mistake underscores this reality. Another real-world example is ‘The Eden Block,’ whose A/B test projected vibrant urban art as a selling point, only to realize post-construction that policies restricting signage and graffiti nullified their appeal. Without a comprehensive understanding of local legislation and cultural fabric, the project’s allure evaporated overnight.

At this juncture, the developer’s path forks. They can either scramble to reclaim their misstep or pivot towards an innovative solution. Opting for transparency, they engage the community in redesign efforts, offering a more inclusive vision. It’s a narrative turn where listening triumphs over telling, and humility surfaces as a powerful corrective.

Internal links to consider are Helping Buyers Imagine and Buyers Need More Than a Floorplan, which underscore the need for empathy and foresight in presentations.

The resolution emerges not from data alone, but from a synthesis of intuition, local expertise, and digital innovation. Real estate professionals must embrace the art of listening as fervently as the science of numbers, ensuring that the next A/B test mistake doesn’t transform into a monumental lapse.